Call Us Today: +1 866 205 2414

In the story of David and Goliath, it looks like Goliath is winning this time! As the giant players in the market just keep growing, the TMG team took an in-depth look into the future of gold reserve estimates and the goliath impact of mergers and acquisitions.

Recent M&As continue to affect the mining industry with a more realistic perspective on reserve estimates.

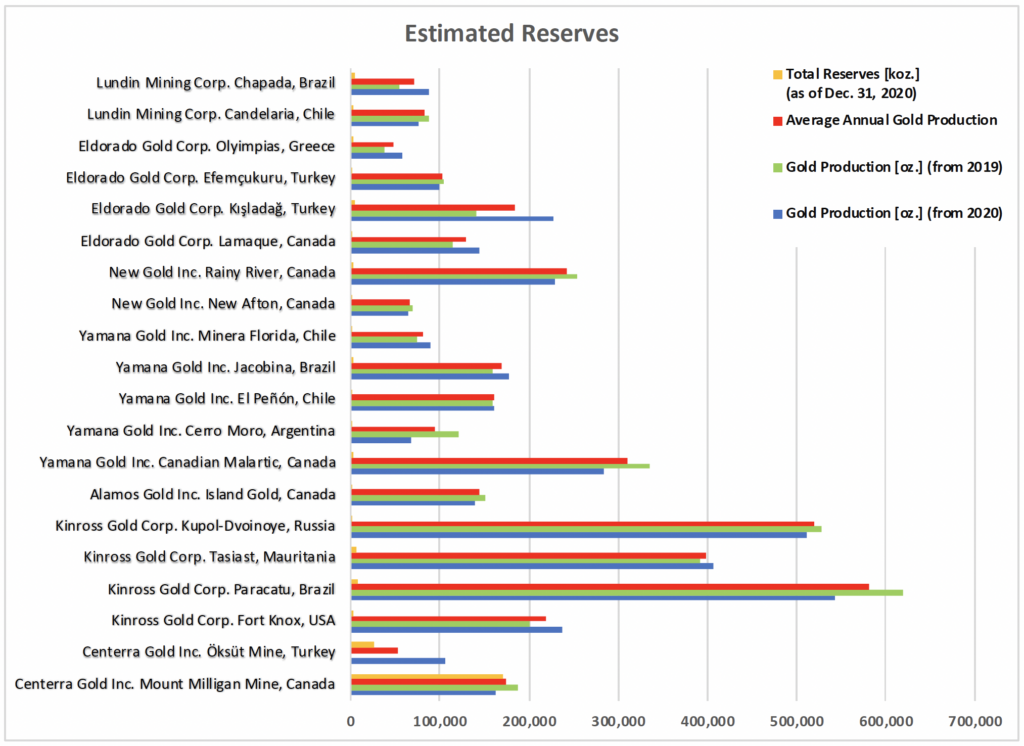

TMG collected Sedar filings and gathered market research, to analyze and compare recent gold production results and total reserves of seven (7) of the world’s top gold producers. Our initial task was to investigate which companies could potentially run out of gold. The analysis provides an interesting perspective when we compare actual production rates with potential mineral reserve estimates. It sheds a clear light on the need to optimize underperforming assets, as well as the need to continue developing new projects. The reality of the larger gold producing companies merging with or acquiring the smaller players, with large reserves, comes as no surprise when the data supports the need to reach maximum potential.

| Issue dates of the Technical Report – NI 43-101 | |

|---|---|

| Lundin Mining: | |

| Chapada Mine, Brazil Candelaria Copper Mining Complex, Chile |

10-Oct-2019 28-Nov-2018 |

| ElDorado Gold: | |

| Kişladağ Gold Mine, Turkey Olympias Mine, Greece Efemçukuru Gold Mine, Turkey Lamaque Project, Canada |

17-Jan-2020 31-Dec-2019 31-Dec-2019 21-Mar-2018 |

| New Gold: | |

| New Afton Mine, Canada Rainy River Mine, Canada |

28-Feb-2020 12-Mar-2020 |

| Yamana Gold: | |

| El Peñón Gold-Silver Mine, Chile Jacobina Gold Mine, Brazil Canadian Malartic Mine, Canada Minera Florida, Chile |

31-Dec-2020 and 2-Mar-2018 31-Dec-2019 and 30-Sep-2019 31-Dec-2020 11-Feb-2021 |

| Alamos Gold Inc: | |

| Island Gold Mine, Canada | 14-Jul-2020 |

| Kinross Gold Corporation: | |

| Paracatu Mine, Brazil Tasiast Project, Mauritania Fort Knox Mine, USA Kupol Mine and Dvoinoye Mine, Russia |

10-Mar-2020 31-Oct-2019 11-Jun-2018 31-Mar-2015 |

| Centerra Gold: | |

| Mount Milligan Mine, Canada Öksüt Gold Project, Turkey |

31-Dec-2019 3-Sep-2015 |

Acquiring companies with large reserves provides instant value and appeal. On paper, these newly merged companies increase their total reserves, in turn increasing Investor, Shareholder, and C-Suite interest and gains. Stocks are instantly made more attractive with a larger reserve estimate. Everyone looks at resources and reserves. Resources tell us that the company has done the analysis and there is a set amount of gold available; while reserves provide the economically feasible reality, essentially setting the true value of a company’s worth.

What makes the most economic sense? The answer in this case, is the bigger (the reserve) the better. It is important for companies to announce that the reserves are there, and it is easy to understand why the giants in the market who are capable of M&As are doing so. It provides confidence to everyone with a stake in the business. Financially, it is a WIN-WIN situation.

It has become consistently clear that in order for larger mining companies to maintain their mineral reserves, they will continue to merge with or acquire smaller companies. While this has already led, and will continue, to provide a huge pipeline of work, with the need for multiple mines producing gold, versus just one or two large assets, which are becoming exceedingly rare nowadays, it is also important for us to focus on the need for continual growth and exploration.

In a 2019 BNN Bloomberg interview, Gary Goldberg, CEO, Newmont Mining (Jan 2019), stated the value of acquisitions as they provide “the flexibility to look across both portfolios and sequence the projects in the right order, in terms of delivering the best value.” [Source]

Mark Bristow, CEO of Barrick in a 2019 BNN Bloomberg article, declared, that “the industry is heading for irrelevance unless there are major changes.” We have indeed seen major changes since then. [Source]

While the industry is seeing new, larger players succeed, we also realize that the days of larger mine sites are becoming fewer. The large companies that have the necessary capital to mine the sites, now need 6 to 7 multiple assets to provide significant results.

M&As have provided a positive market response and have resulted in companies buying for exploration purposes. It is evident that the uptick in mergers and acquisitions in the mining industry makes sense for companies that have underperformed. A property may show promise, and provide a healthy reserve estimate, which then allows for the accumulation of a larger total reserve estimate – this creates instant appeal and value in the market. It is TMG’s perspective that we can expect this trend of more consolidation to continue as we move forward. Companies have combined platforms of mining assets and have made smart moves to adjust their portfolios.

But we also need to consider the harsh reality in mining is that, if you’re not committed to growth, you’re heading towards a stark end, with reserves being depleted every day that you are in production. It is essential that someone – either the junior or senior mining companies – replace the reserves through the development of studies and capital projects, so that the mining assets continue to be available for development and for acquisition. According to TMG President, Peter Woodhouse, “mergers and acquisitions do not add reserves to our industry, which is being depleted on a daily basis. Only new projects add actual reserves, and this is where the difficulty lies. While some of the major mining companies have pared down their internal greenfields exploration teams, we must highlight that exploration assets are essential to the continual growth of the mining industry.”

TTMG is passionate about providing tailored services for mining projects through collaborative goal-oriented teams, to deliver value-add opportunities and innovation, in partnership with our clients to meet their needs. We will always take an objective, consultative approach to each and every thoughtful insight and recommendation.

Your TMG Team

TMG provides a unique oversight service to mining company executives and project owners who are, or will be, engaged in growing or enhancing their enterprise through capital projects. Our collective years of expertise enable us to get things done faster – ultimately saving you precious time, and helping you honour your project budget. In an industry where timing is everything, bringing TMG in at the right stage of your investment to be the eyes and ears for the project is critical.

Let’s connect and discover how we can help you bring your projects in on time.

TMG specializes in executive and operational consulting for the mining and oil and gas sectors. It offers tailored oversight and strategic guidance across all project stages to ensure optimal outcomes from conception to execution.

TMG committed to diversity and inclusion, based on the undisputed fact, that a fully inclusive environment, fosters a unique perspectives that can solve challenging problems and creates value, within the company, for our clients, the communities of which we work, and the world at large.

TMG’s corporate vision and values, are to honour the rights and cultures of all people and respectfully approach all business, with fair dealings and establishing and maintain a mutually respectful relationship.

TMG acknowledges that our offices are located on traditional lands of divers First Nations and Indigenous peoples. Guided by the Constitution of both Canada & the USA, the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) and the recommendations of all Truth and Reconciliation Commission as a framework, we are committed to taking ongoing positive and concrete steps towards reconciliation.